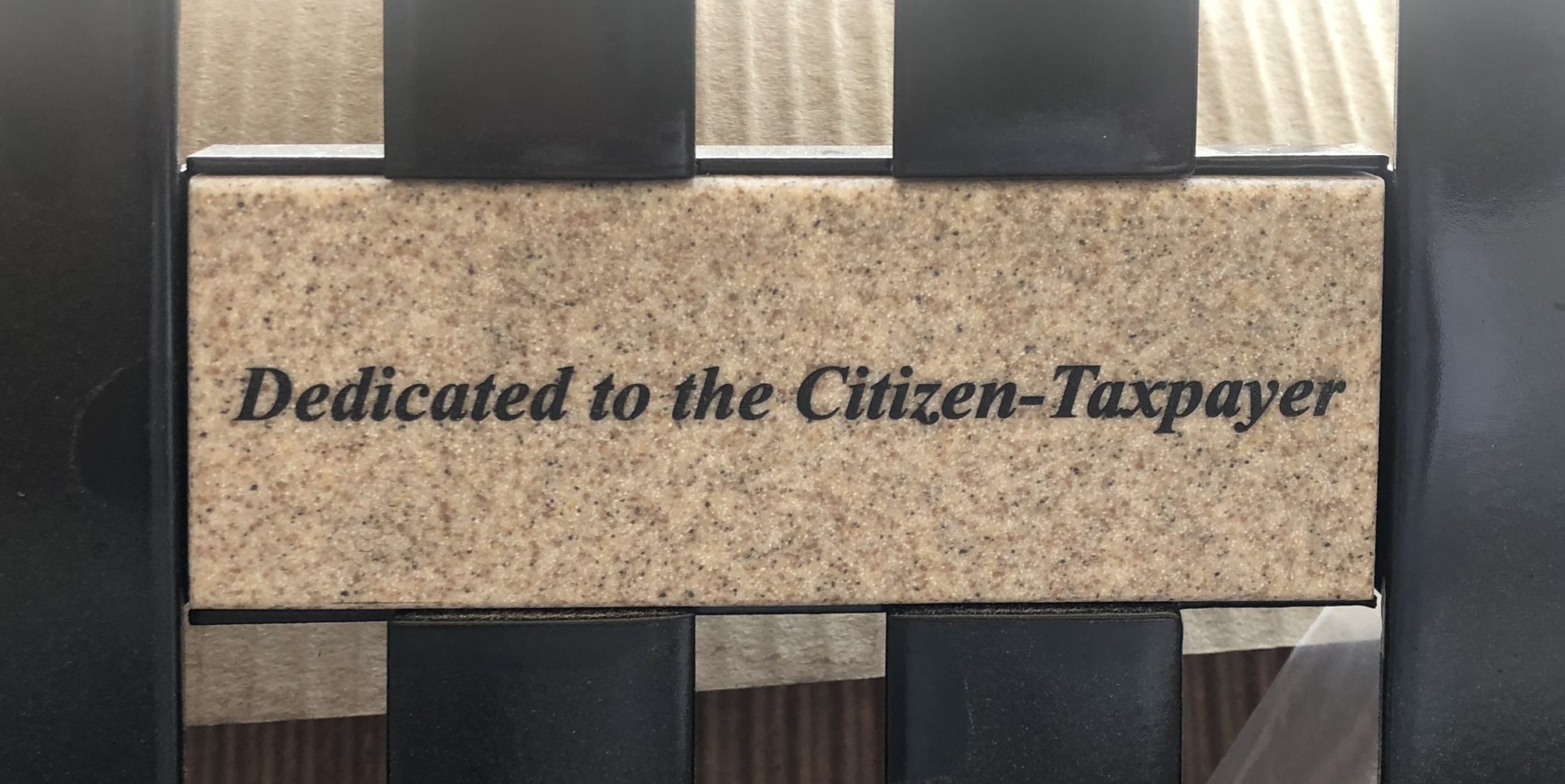

There is a new bench placed on the York University Common with a plaque that reads “Dedicated to the Citizen-Taxpayer.” It is in honour of all citizens, across the world, who feel a sense of pride and duty in paying their taxes. Taxes are in part used to pay for the social infrastructure that is there to serve the collective and to make life more decent for everybody. Infrastructure that includes universities.

Some people may object to such a dedication because they find faults and inefficiencies and abuses in the tax system. Some think their taxes go to the wrong causes, including a bloated bureaucracy of civil servants. Some feel they pay too many taxes and their taxes are too high. Others feel that the rich pay too little and the poor too much. These are notions that many of us internalize - that tax authorities are villains and that we pay excessive or even unnecessary taxes. But how about if we challenged the notion of the tax system as chronically villainous, inefficient and excessive?

What if we showed that many taxes uphold power, privilege, and the accumulation of wealth, and then worked hard to correct it? What if we examined the tax system as supporting social services, the public health system, schools, and public infrastructure? What if we celebrated and honoured the citizen-taxpayer who is the major contributor to the social and public infrastructure of any nation state? Why not begin to celebrate hard-fought collective values and institutions that are supported by taxes. Why not celebrate welfare state and public institutions like the daycare, the school, the university, the art gallery, the water fountain, the park, and the hospital as a sacred heritage that needs to be supported and maintained for both prosperity and posterity?

Close-up of the plaque on the bench

The bench and plaque dedicated to the citizen-taxpayer was conceived with this in mind. It started with a search for an institution that would support the endeavour. The most logical place was the York University’s Advancement Office, which runs various recognition- and fund-raising programmes. Such programmes have become an integral part of all universities’ revenue streams. Fund-raising divisions have large staffs and their heads are paid top dollars - often equivalent to, or exceeding those of university presidents. In some ways, the funds raised make up for the monies government does not provide, especially on the bricks and mortar side.

But I had trepidations approaching the Office. At first, it seemed contradictory to approach an institution dealing with charitable donations while celebrating an institution dealing with taxes. Most plaques at the University commemorate private individuals, private businesses or organizations. The donors receive tax receipts. I feared the Advancement staff might look askance at this initiative. After all, the very idea of a bench celebrating the citizen taxpayer could be seen as an implicit challenge to that office’s mandate, by praise of public rather than private donations. However, my fears proved unfounded and the $3,500 gift for the bench and plaque was readily accepted. But in contrast to most donors, I never filed the tax receipt. I had similar hesitations approaching YFile, the University’s journal of record and campus newsletter which often celebrates major donations to the University but was pleased to see it welcome and publish a shorter version of the story on the bench. (https://yfile.news.yorku.ca/2022/08/12/professor-honours-the-citizen-taxpayer-with-enduring-gesture/).

The words on the plaque were inspired by Shirley Tillotson’s book, Give and Take: The Citizen-Taxpayer and the Rise of Canadian Democracy. Tillotson argues that citizens and taxpayers are often seen as opposing concepts. Citizens are socially minded and speak up for the collective. Taxpayers, by contrast, are seen as selfish individualists who strive to minimize their tax payments as much as possible. But Tillotson shows that the picture is more complex. In the nineteenth century, citizenship was often associated with taxation, where property owners who paid taxes felt they should have a more weighty political voice than the non-propertied. In the twentieth century, particularly since the onset of the post-war welfare state, citizen-taxpayers became involved in promoting “tough conversations about how to define and pay for our collective life.”

Today, in the twenty-first century, the prevailing view is of an overburdened taxpayer, groaning under too many and too much tax. This conception surrounds us. A few months ago, I was listening to Jazz FM 91.1. An advertiser asked listeners to contemplate where they would like their inheritance to go. Would they like it to flow to Revenue Canada, to their offspring, or to one or more of their favourite charities? His answer was the latter two and he and his firm were there to help. Just call the number provided. Revenue Canada appears as an adversary, an institution trying to deprive us of our just desserts.

One important reason that prompted the citizen-taxpayer bench was to provide a modest counterweight to the celebration of the wealthy benefactors whose names are honoured on university buildings and other features around the campus. They are primarily businessmen who have made millions, even billions, and who are now leaving their legacies by donating money to the university. Seymour Schulich, whose name dons the business building, is an outspoken critic of taxes that are so high as to trigger a flight of capital (Gollom, 2011) The Sherman family’s name adorns the Health Science Research Centre, in recognition of their donations to the University, even though the patriarch, Barry Sherman routinely litigated Health Canada, costing the Canadian taxpayers millions of dollars(Kingston and Friscolanti, 2018). And Victor Phillip Dahdaleh whose name appears on a building containing the Faculty of Health was the centre of bribery scandals orchestrated through tax havens in the British Virgin Islands (Cribb, 2016).

What if we began to challenge, or at least supplement, the narrative of the generous corporate benefactor and instead ask a tougher set of questions? Why should we celebrate men who have amassed fortunes, sometimes through nefarious (but legal) means, and who have so much money that “charitable” acts will not affect their economic standing, but, instead, provide them with name recognition and tax advantage? What if we closed tax loopholes and taxed them enough to not require their donations? (Reich, 2021; see also Kapoor, 2012)

Behnaz taking a break on the Citizen-Taxpayer Bench

These are in fact calls answered by groups of European millionaires who are calling on their governments to tax them in order to meet the growing national and international inequities (Neate, 2022). Appearing at the recent World Economic Forum conference in Davos, where the world’s most influential and affluent political and economic leaders gather, one of the representatives of the movement urged that the delegates themselves be taxed more and added: “It’s outrageous that our political leaders listen to those who have the most, know the least about the economic impact of this crisis, and many of whom pay infamously little in taxes…” (quoted in Tangerman, 2022).

A final factor that inspired the citizen-taxpayer bench project is the lack of memorials or celebration of valued public investment. Instead, the internet is full of entries concerning the “misuse” of taxpayers’ money in sponsoring or maintaining memorials or sculptures of various kinds.

History Professor Bill Wicken trying out the Citizen-Taxpayer Bench

The citizen-taxpayer bench at the York University Common is a modest gesture toward the celebration of citizen-taxpayers all over the world. They should be given their due. They are the ones who sustain society, and they deserve to be honoured and celebrated for their efforts. Now they also have a commemorative bench with a plaque.

Endnote:

1 Song lyrics, You Make Me Like Charity (2003), The Knife. The Knife was a Swedish electronic music sibling duo that formed in 1999 and disbanded in 2014. Thanks to Tor Sandberg for directing my attention to this source.

References:

Cribb, R. (2016) Panama Papers: British-Canadian billionaire mysterious middleman in ‘corruption scheme’. Toronto Star, 25 May. https://www.thestar.com/news/world/2016/05/25/panama-papers-british-canadian-billionaire-mysterious-middleman-in-corruption-scheme.html

Gollom, M. (2011) Should Canadian millionaires pay more taxes? CBC News, 20 December. https://www.cbc.ca/news/business/should-canadian-millionaires-pay-more-taxes-1.1106636

Kapoor, I. (2012) Celebrity Humanitarianism: The Ideology of Global Charity. London: Routledge.

Kingston, A. and M. Friscolanti (2018) The other side of Barry Sherman. MacLeans, 5 April. https://www.macleans.ca/news/canada/barry-honey-sherman-murders/

Neate, R. (2022) Millionaires join Davos protests, demanding ‘tax us now’ The Guardian, 22 May. https://www.theguardian.com/business/2022/may/22/millionaires-join-davos-protests-demanding-tax-us-now-taxation-wealthy-cost-of-living-crisis

Reich, R. (2021) Is Billionaire Philanthropy a Sham? https://robertreich.org/post/661071322181419008

Tammermann, V. (2022) Millionaires Protest, Demanding to Pay More Taxes. The Byte, 23 May. https://futurism.com/the-byte/millionaires-protest-demanding-pay-more-taxes

Tillotson, S. (2017) Give and Take: The Citizen-Taxpayer and the Rise of Canadian Democracy. Vancouver: University of British Columbia Press.